Cardiogeni PLC - Annual Results to 31 March 2025

Announcement provided by

Cardiogeni Plc · CGNI30/09/2025 17:51

30 September 2025

Cardiogeni plc

("Cardiogeni" or the "Company")

Annual Results to 31 March 2025

Cardiogeni PLC (AQSE: CGNI) is pleased to announce its audited results for the 12 months ended 31 March 2025.

A copy of the annual report will be posted on the Company's website: https://www.cardiogeni.com

The Directors of Cardiogeni PLC accept responsibility for this announcement.

Enquiries:

|

Cardiogeni PLC |

|

|

Dr Darrin M Disley, Executive Chairman Ajan Reginald, Executive Officer |

Via First Sentinel |

|

First Sentinel Corporate Finance Limited, Corporate Adviser |

|

|

Brian Stockbridge |

+44 (0) 7858 888007 |

|

SP Angel Corporate Finance LLP, Corporate Broker |

|

|

David Hignell Vadim Alexandre Devik Mehta |

+44 20 3470 0470 |

ISIN: GB00BTBLFC12

About Cardiogeni

Founded by Nobel Laureate, Professor Sir Martin Evans, the Cardiogeni Group ("the Group") is developing a new class of life-saving cellular medicines. The Group's platform technology enables the creation of unique (living) cells that are engineered with a therapeutic function. The Group's lead product, CLXR-001, is a patented engineered cellular medicine to treat heart failure patients which is administered during coronary artery bypass grafting surgery. The Group's novel tissue engineering technology was developed in-house by Professor Sir Martin Evans and is protected by a portfolio of ~100 international patents and trademarks. CLXR-001 targets heart failure and consists of a novel allogeneic (off-the-shelf) cell type, iMP cells, engineered for cardiac regeneration. Heart failure will affect 1 in 4 people in their lifetime and is not reversible or curable. This technology is expected to regenerate the damaged heart tissue restoring heart function and improving life expectancy and quality of life. CLXR-001 has successfully completed an EU Phase II clinical trial in which patients showed a statistically significant (P<0.05) improvement in all parameters including heart function, reduction in heart scarring and an improvement in quality of life. Cardiogeni is headquartered in the

Note

This announcement may contain "forward-looking" statements and information relating to the Company. These statements are based on the beliefs of Company management, as well as assumptions made by and information currently available to Company management. The Company does not undertake to update forward‐looking statements or forward‐looking information, except as required by law.

Chairman's statement

I am pleased to report Cardiogeni PLC's full-year results for the year ending 31 March 2025.

The highlights for the period are listed below:

· Listed the company's entire share capital consisting of ordinary shares of

· Appointed Professor Jo Martin as Non-Executive Director on Admission to AQSE

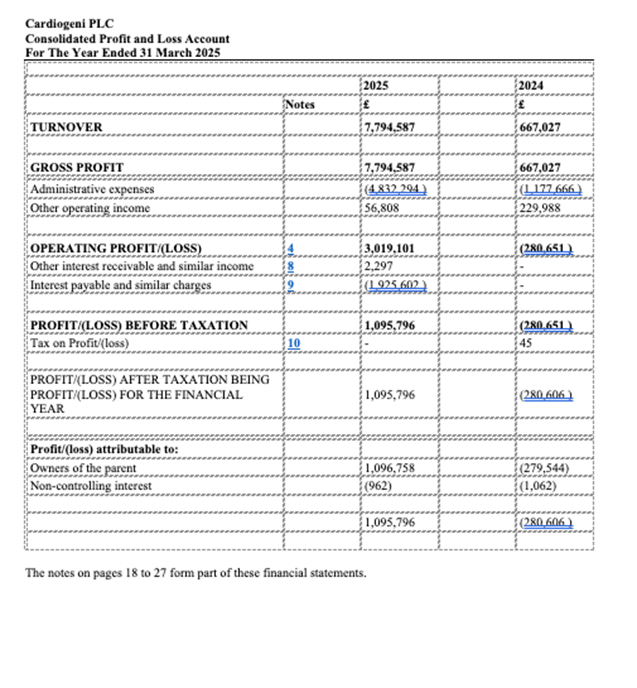

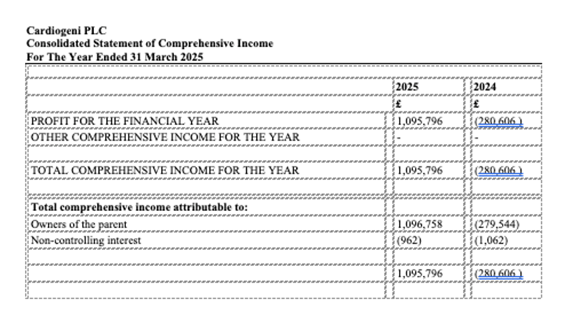

· Turnover for the year was

· The profit per share was

· Directors have kept operational costs at a minimum, including entering agreements to take no remuneration until

· No dividends have been declared for the year ended 31 March 2025.

· Company has been audited as a going concern.

· Please note the ability of the company to continue as a going concern relies upon future funding to be secured and the directors acknowledge that there can be no absolute certainty that funding will be available to the company and thus this constitutes a material uncertainty on the company's ability to continue as a going concern

Post Period-End Highlights

· Formed a joint venture company in the

· The principal terms of the JV include

· Raised

· Appointed SP Angel Corporate Finance LLP as the Company's Corporate Broker.

· Announced an EIS funding round including advanced subscription agreements of

· Appointed Lord James Bethell as Non-Executive Director

The increased turnover of

The most significant update in the period was the formation of Cardiogeni Limited

Through this JV, the Company is expected to generate significant short-term value by initiating and completing a Phase 2b/3 clinical trial of its lead product CLXR001 in c200 heart failure patients. This trial is expected to be conducted across hospitals in the

It is expected that interim patient data will be available within 12 months of the first patient being dosed. A directionally positive outcome versus the trials' main endpoints could represent a significant value inflection point to initiate discussions with specialist institutional funders (e.g. Pharma) as well as geographic partners for licensing and co-development opportunities in the lucrative,

While progressing the clinical and corporate development strategy in the

Further, the Company has completed two

The Company is very excited by the progress made since listing on AQUIS and would like to thank its existing shareholders and new investors for their support as we execute on our mission to become the world-leader in the development and commercialisation of novel cell therapies targeting early and mid-stage heart failure.

Dr Darrin Disley

Executive Chairman

30 September 2025

Corporate Governance

As Chairman of the Board of Directors of Cardiogeni PLC (the Company), it is my responsibility to ensure that the Company has sound corporate governance including an effective Board and committees. The Company is an AQUIS listed Company focused on the development and commercialisation of novel cellular medicines targeting early and mid-stage heart failure. The Company has made it a strategic priority to complete a pivotal Phase 2b/3 study and gain a first market approval for its lead product CLXR-001 in a suitable jurisdiction and then form strategic funding and collaboration agreements to develop and commercialise the product in the US, EU,

The Company has adopted the principles of the Quoted Companies Alliance Corporate Governance Code (QCA Code) for small and mid-size quoted companies. The QCA Code identifies ten principles that they consider to be appropriate and asks companies to provide an explanation on how they are meeting these principles. The Board considers that the Company complies with the QCA Code so far as it is practicable, having regard to the size and complexity of the Company and its business.

These disclosures are set out on the basis of the current Company and the Board highlights where it has departed from the Code presently.

The following paragraphs set out the Company's compliance with the ten principles of the QCA code. The information was last updated on the Company's website on 29 August 2025.

1. Establish a strategy and business model which promotes long-term value for shareholders

The Company's strategy is to develop valuable regulated pharmaceutical medicines for heart failure and has formed Cardiogeni

Through this JV the Company is expected to generate significant short-term value by initiating and completing a Phase 2b/3 clinical trial of its lead product CLXR001 in c200 heart failure patients. This trial is expected to be conducted across hospitals in the

It is expected that interim patient data will be available within 12 months of the first patient being dosed. A directionally positive outcome versus the trial's main endpoints could represent a significant value inflection point to initiate discussions with specialist institutional funders (e.g. Pharma) as well as geographic partners for licensing and co-development opportunities in the lucrative,

2. Seek to understand and meet shareholder needs and expectations

The Company is committed to communicating openly with its shareholders to ensure that its strategy, business model and performance are clearly understood. The principal forms of communication are the Annual Report and Accounts, quarterly trading updates, other Regulatory News Service announcements and its website.

The Company also maintains a dialogue with shareholders through Annual General Meetings, which provides an opportunity to meet, listen to and present to shareholders. Shareholders are encouraged to attend in order to express their views on the Company's business activities and performance.

External PR and IR advisers have been appointed, but there is only limited broker or analyst coverage at this stage. The Company's website is kept updated and contains details of relevant developments and has a facility for questions to be addressed to the Company and it is the Board's commitment that all reasonable questions are answered promptly.

Dr Darrin M Disley OBE is responsible for shareholder liaison, and his contact details are on all announcements made by the Company.

3. Take into account wider stakeholder and social responsibilities and their implications for long-term success

The Company's business is focused on identifying and appraising opportunities. Stakeholder and social responsibilities in terms of impact on society, the communities within which the Company operates and the operating environment apply less than that of an operating Company. Therefore, the Company appraises its social responsibilities as part of its investment appraisal process.

The key resource on which the Company relies is the collective experience of the Directors and employees. All employees within the Company are valued members of the team, and the Board seeks to implement provisions to retain and incentivise all its employees.

As an equal opportunity employer, we are committed to embedding equality and inclusion in all our practices and aim to establish an inclusive culture, that celebrates diversity, is free from discrimination and based on the values of dignity and respect.

In terms of its shareholders, the Company aims to provide transparent and balanced information to encourage support and confidence in the Board's approach.

The Board recognises that the long-term success of the Company is reliant upon the efforts of its stakeholders and has close ongoing relationships with a broad range of its stakeholders.

4. Embed effective risk management, considering the opportunities and threats, throughout the organisation

The Board recognises the need for an effective and well-defined risk management process, and it oversees and regularly reviews the current risk management and internal control mechanisms.

The Board considers risk management to fall into two broad categories, being the corporate and business development activity of the Company and the operations of the Company:

(a) The corporate and business development risk is considered as part of the appraisal processes and by way of due diligence and ongoing monitoring.

(b) The Company uses internal appraisal and an annual audit to ensure financial risks are evaluated in detail. Board meetings are also used for the Directors to raise any issues relating to business risk arising from the Company's business model and operations.

Dealings in the Company's shares are monitored, and any dealings must first be approved by the Chairman.

The Board considers that an internal audit function is not necessary or practical due to the size of the Company and the day-to-day control exercised by the Directors. However, the Board will monitor the need for an internal audit function. The Board has established appropriate reporting and control mechanisms to ensure the effectiveness of its control systems.

5. Maintain the Board as a well-functioning, balanced team led by the Chair

The Board recognises the QCA recommendation for a balance between Executive and Non-Executive Directors and the recommendation that there be at least two Independent Non-Executives. The Board consists of six directors, the Chairman, the Chief Scientist and the Executive Director and three non-executive Directors. The Board maintains that the Board's composition will be frequently reviewed as the Company develops.

The Company has in place four committees; the Audit, Compliance, Nominations and Remuneration Committees all of which comprise a balanced membership of executive and non-executive Directors.

The Directors of the Company are committed to sound governance of the business and each devotes sufficient time to ensure this happens. The Board holds several Board meetings per year and at least two committee meetings. Board meetings cover regular business, investments, finance and operations. The Chairman prepares the Board agenda and circulates relevant documents. The Chairman is responsible for ensuring that relevant and accurate information is supplied for all Board and committee meetings.

6. Ensure that between them the Directors have the necessary up-to-date experience, skills and capabilities

The Company believes that the Board as a whole has significant experience in the Biopharmaceutical industry and business development.

The Board believes they have the requisite mix of skills and experience to successfully execute the business strategy in order to meet the Company's objectives.

Darrin Disley, age 57 - Executive Chairman

Darrin is a scientist, entrepreneur, angel investor and enterprise champion who has started, grown, or invested in over 40 start-up life science, technology and social enterprises, with significant fundraising and deal-making experience. Darrin is currently a non-executive director of Roquefort Therapeutics PLC, a biotech company listed on the Main Market of the London Stock Exchange (LSE). He was CEO of Horizon Discovery Group plc for 11 years, during which he led the company from start-up through a

Ajan Reginald, age 53 - Executive Director

Ajan is an experienced biotechnology CEO with a track record in drug development, biotech transactions and commercialisation. Over 20 years, he has served as the Global Head of Emerging Technologies for Roche Group (SWX: ROG) and Business Development Director, Roche Pharmaceuticals; Chief Operating Officer and Chief Technology Officer of Novacyt S.A (LON: NCYT); and CEO of Roquefort Therapeutics PLC (LON: ROQ). Ajan is a graduate of the University of Oxford (MSc Experimental Therapeutics), Kellogg Business School (MBA) Northwestern University and University of

Professor Sir Martin Evans, age 84 - Chief Scientific Officer

Sir Martin was the first scientist to identify embryonic stem cells, which can be adapted for a wide variety of medical purposes. His discoveries are now being applied in virtually all areas of biomedicine - from basic research to the development of new therapies. In 2007, he was awarded the Nobel Prize for Medicine, the most prestigious honour in world science, for these "ground-breaking discoveries concerning embryonic stem cells and DNA recombination in mammals." Sir Martin has published more than 120 scientific papers. He was elected a Fellow of the Royal Society in 1993 and is a founder Fellow of the Academy of Medical Sciences. He was awarded the Walter Cottman Fellowship and the William Bate Hardy Prizes in 2003 and in 2001 was awarded the Albert Lasker Medal for Basic Medical Research in the US. In 2002 he was awarded an honorary doctorate from Mount Sinai School of Medicine in

Professor Joanne Martin, age 65 -Independent Non-Executive Director

Professor Martin graduated from

Chaim Hurvitz, age 64 - Independent Non-Executive Director

Chaim currently serves as the CEO of CH Health, a private venture capital firm, a position he has held since May 2011, and as a non-executive director of NRX Pharmaceuticals Inc (NASDAQ: NRXP). Chaim was previously a director of Galmed Pharmaceuticals (NASDAQ: GLMD), Teva Pharmaceuticals Industries Ltd and Polypid (NASDAQ: PYPD). Previously, he was a member of the senior management of Teva Pharmaceuticals Industries Ltd., serving as the President of Teva International Group from 2002 until 2010, as President and CEO of Teva Pharmaceuticals Europe from 1992 to 1999 and as Vice President - Israeli Pharmaceutical Sales from 1999 until 2002. Chaim holds a Bachelor of Arts degree in political science and economics from

After the Period, on the 29th August 2025, Lord James Bethell, was appointed to the board as a non-executive director of the Company

Lord James Bethell, age 57 - Independent Non-Executive Director

James is an entrepreneur, former health minister and champion for public health. He has a twenty-year track record working across government, media and industry, working at The Sunday Times, the US Senate, the EU Commission and the British government. He has built and sold communications companies and helped make the Ministry of Sound a global success story. As a minister at the Department for Health and Social Care, he helped lead the

7. Evaluate Board performance based on clear and relevant objectives, seeking continuous improvement

The Directors consider that the Company and Board are not yet of a sufficient size and complexity for a full Board evaluation to make commercial and practical sense. The Board acknowledges that it is non-compliant with its processes to evaluate the performance of the Board. As the Company grows it is expected that the Board will need to expand and, with this, Board evaluation will be required.

In view of the size of the Board, the responsibility for proposing and assessing candidates to the Board as well as succession planning is retained by the Board. All Directors submit themselves for re-election at AGMs at regular intervals.

8. Promote a corporate culture that is based on ethical values and behaviours

The Board believes that by acting ethically and promoting strong core values it will gain a reputation for honesty and that this will attract business and help the long-term objectives of the Company. As such the Board adopts an open approach to all investors, investment opportunities and all its advisers and service providers.

The Board further considers the activities of and persons involved with potential investee companies as part of its due diligence processes.

The Board places great importance on the responsibility of accurate financial statements and auditing standards comply with Auditing Practice Board's (APB's) and Ethical Standards for Auditors. The Board places great importance on accuracy and honesty and seeks to ensure that this aspect of corporate life flows through all that the Company does.

A large part of the Company's activities is centred upon an open and respectful dialogue with stakeholders. The Directors consider that the Company has an open culture facilitating comprehensive dialogue and feedback. The Board maintains that as the Company grows it intends to maintain and develop strong processes which promote ethical values and behaviours across the Company.

The Company has adopted a code for Directors' dealings appropriate for a Company whose shares are admitted to trading on AQUIS and takes all reasonable steps to ensure compliance by the Board of Directors.

9. Maintain governance structures and processes that are fit for purpose and support good decision-making by the Board

The Board is committed to, and ultimately responsible for, high standards of corporate governance and notes the departure from the Code in terms of independence on the Board. The Board reviews the Company's corporate governance arrangements regularly and expects these to evolve over time, in line with the Company's growth. The Board delegates responsibilities to Committees and individuals as it sees fit.

It is the role of the Chairman to manage the Board and advise on its conduct.

The Chairman is responsible for the day-to-day management of the Company's activities.

The matters reserved for the Board are:

a) Defining the long-term strategy for the Company.

b) Approving all major investments, licensing, M&A and partnerships.

c) Approving any changes to the Capital and debt structure of the Company.

d) Approving the full year and half year results and reports.

e) Approving resolutions to be put to the AGM and any general meetings of the Company.

f) Approving changes to the Advisory team.

g) Approving changes to the Board structure.

The Board delegates authority to the Audit and Remuneration Committees to assist in meeting its business objectives and the Committees meet independently of Board meetings. The membership of each Committee is listed below.

Audit Committee: The Board has established an Audit Committee with formally delegated duties and responsibilities. The Audit Committee is chaired by Chaim Hurvitz, and its other member will initially be Ajan Reginald. The Audit Committee will meet at least twice a year and will be responsible for ensuring the financial performance of the Company is properly reported on and monitored, including reviews of the annual and interim accounts, results announcements, internal control systems and procedures and accounting policies, as well as keeping under review the categorisation, monitoring and overall effectiveness of the Company's risk assessment and internal control processes, and to review the Company's internal financial controls and the Company's internal control and risk management systems.

Remuneration Committee: The remuneration committee, which comprises Professor Joanne Martin and Dr. Darrin M Disley, is responsible for the review and recommendation of the scale and structure of remuneration for the Company's senior executives, including any bonus arrangements or the award of share options with due regard to the interests of the Shareholders and the performance of the Company. The Remuneration Committee is chaired by Dr. Darrin Disley and will meet at least twice a year.

Nominations Committee: The Nomination Committee will lead the process for board appointments and make recommendations to the Board. The Nomination Committee shall evaluate the balance of skills, experience, independence and knowledge on the board and, in the light of this evaluation, prepare a description of the role and capabilities required for a particular appointment. The Nomination Committee will meet as and when necessary, but at least twice each year. The Nomination Committee will comprise Dr. Darrin M Disley (as chairman) and Professor Joanne Martin.

Aquis Rule Compliance Committee: The Aquis Rules Compliance Committee will be responsible for ensuring adherence to the Aquis Rules and regulations, including continuous monitoring of compliance with market rules, disclosure obligations, and governance standards. The committee will oversee timely and accurate financial and non-financial disclosures, ensure appropriate handling of inside information, and manage compliance with corporate governance requirements. It will review the conduct of directors and officers, monitor related party transactions, and regularly reports to the board on compliance issues, identifying legal and regulatory risks. The Aquis Rule Compliance Committee, which will comprise Dr. Darrin M Disley and Ajan Reginald, will meet not less than once a year. The Aquis Rule Compliance Committee is chaired by Dr. Darrin M Disley.

10. Communicate how the Company is governed and is performing by maintaining a dialogue with shareholders and other relevant stakeholders

The Board is committed to maintaining effective communication and having constructive dialogue with its stakeholders. All shareholders are encouraged to attend the Company's Annual General Meeting, and the Board discloses the result of General Meetings by way of announcement. All AGM resolutions in the financial year were passed comfortably.

The Company's website includes all historic Annual Reports, results announcements and presentations, and other governance-related material. These can be found in the Investor Relations section. This section of the website also includes the results of all AGMs.

Information on the Investor Relations section of the Company's website is updated and contains details of relevant developments, regulatory announcements, financial reports and shareholder circulars.

Dr Darrin Disley

Executive Chairman

30 September 2025

The Directors present their strategic report for the year ended 31 March 2025.

Review of Business

The company has made great progress versus its strategic plan in the period to 31March 2025 and the post period leading up to the publication of these results including the key events highlighted and explanation of the profitability in the period described above.

The Cardiogeni

The JV's significance is because the Company expects interim expects interim clinical trial results within 12 months of the first patient being dosed. A directionally positive set of results could generate a significant value inflection point and lead to the initiation of discussions with specialist institutional funders (e.g. Pharma) as well as geographic partners for licensing and co-development opportunities in the lucrative,

Principal risks and uncertainties

The Group has exposure to the following risks and uncertainties:

Early-stage technology companies present an opportunity for potentially high returns, but at the same time these companies are pre-revenue and their business models may not prove to be as successful as hoped.

If any of the following risks were to materialise, the Company's business, financial conditions, results or future operations could be materially adversely affected. Additional risks and uncertainties not presently known to the Directors, or which the Directors currently deem immaterial, may also have an adverse effect upon the Company.

In that case, the market price of the Ordinary Shares could decline and all or part of an investment in the Ordinary Shares could be lost.

The list below is not exhaustive, nor is it an explanation of all the risk factors involved in investing in the Company and nor are the risks set out in any order of priority.

1. New technology development may fail:

The technologies being developed by the Group are new and at an early stage of development. Pioneering new technologies and the uncertainty and challenges associated with it introduce a significant risk that these innovations may not achieve the intended technical or commercial success. These challenges could include difficulties in achieving the desired performance, reliability, scalability, or cost-efficiency. Even with robust research and development processes in place, there is no guarantee that the Group's technologies will perform as expected or be viable for commercial production. Drug development and clinical trials carry significant risk with most candidate drugs failing in clinical trials. Investors should be aware that any failure in these efforts could have a material adverse effect on the Group's financial condition, operations, and prospects.

2. New technology and products may not gain regulatory approvals:

Although the Group's trial results for CLXR-001 have shown promising results, there is no guarantee that these results will be replicated in further trials. Even with positive results, there is still a risk that the products fail to achieve the necessary approvals in a timely manner, delaying or reducing the generation of revenues. The Group may as a result need to seek additional funding, which may or may not be forthcoming.

3. The Group's ability to compete will depend in part, upon the successful protection of its intellectual property, in particular its Patents Rights and Know-How:

The Group seeks to protect its intellectual property through the filing of patent applications, as well as robust confidentiality obligations on its employees. Filing, prosecuting and defending patents in all countries throughout the world would be prohibitively expensive. It is possible that competitors will use the technologies in jurisdictions where the Group has not registered patents. Patent applications may not be granted, and costs may be incurred in protecting against patent challenges. Patents may be challenged at any time, and the company has provision for patent litigation insurance. Any such claims are likely to be expensive to defend, and the other litigating parties may be able to sustain the costs of complex patent litigation more effectively than the Group can, because they have substantially greater resources. Moreover, even if the Group is successful in defending any infringement proceedings, it may incur substantial costs and divert management's time and attention in doing so, which may have a material adverse effect on the Group's business, financial condition, capital resources, results and/or future operations. Further, disputes can often last for a number of years and can be subject to lengthy appeals processes before any final resolution is achieved through the various different courts and/or tribunals. Furthermore, it cannot be guaranteed that a court will not rule against the Group were such claims to be defended. The Company is not currently aware of any such active or pending litigation risk.

4. Competition and the pace of development in the biotechnology sector could lead to other market participants creating approaches, products and services equivalent or superior to the diagnostic testing products and services than those to be offered by the Group:

The Group operates within the biotechnology sector, a complex area of the healthcare industry. Rapid scientific and technological change within the biotechnology sector could lead to other market participants creating approaches, products and services equivalent or superior to the diagnostic testing products and services than those to be offered by the Group, which could adversely affect the Group's performance and success. Better resourced competitors may be able to devote more time and capital towards the research and development process, which, in turn, could lead to scientific and/or technological breakthroughs that may materially alter the outlook or focus for markets in which the Group will operate. If the Group is unable to keep pace with the changes in the biotechnology sector and in the wider healthcare industry, the demand for its platforms and associated products and services could fall, which may have a material adverse effect on the Group's business, financial condition, capital resources, results and/or future operations. In addition, certain of the Group's competitors may have significantly greater financial and human resource capacity and, as such, better manufacturing capability or sales and marketing expertise. New companies with alternative technologies and products may also emerge. Any of these events may have a material adverse effect on the Group's business, financial condition, capital resources, results and/or future operations. 5. Dependence on and retention of key employees The Group is currently dependent on a small number of highly skilled and experienced scientific staff which if lost could have a significant impact on the business. Whilst appropriate key man insurance cover and incentives to retain key staff are in place, these risks cannot be fully eliminated.

5. Dependence on and retention of key employees:

The Group is currently dependent on a small number of highly skilled and experienced scientific staff which if lost could have a significant impact on the business. Whilst appropriate key man insurance cover and incentives to retain key staff are in place, these risks cannot be fully eliminated.

6. Availability of further funding: The Company is confident that it will obtain sufficient resources to complete its CLXR-001 programme. However, due to the inherent uncertainties of bringing new products to market, there can be no absolute guarantee that the Company will not need to undertake further rounds of equity financing in the future and no guarantee that, should this be necessary, such funding would be forthcoming. Nevertheless, the Directors believe that significant value could be obtained from further licensing of CLXR-001 to a third-party pharmaceutical company and that the ongoing potential to do so in the future provides some mitigation against potential future funding constraints.

7. Growth Risk: There can be no guarantee that the Company will be able to effectively manage the growth of its operations or that the Company's current personnel, systems, procedures and controls will be adequate to support the Company's operations. Any failure of the Board to effectively manage the Company's growth and development may have material adverse effects on the Company's business, financial condition, results and/or future operations. There is no certainty that all, or indeed any, of the elements of the Company's current strategy will develop as anticipated and that the Company will be profitable.

8. Dilution of Shareholders' interests as a result of additional equity fundraising: Whilst it is the opinion of the Directors that the Company's working capital is sufficient for its present requirements, further funding may be required by the Company to develop its business model and commercial activities. If additional funds are raised through the issue of new equity or equity-linked securities of the Company other than on a pro rata basis to existing Shareholders, the percentage ownership of the existing Shareholders may be reduced. Shareholders may experience subsequent dilution and/or such securities may have preferred rights, options and pre-emption rights senior to Ordinary Shares. The Company may issue Ordinary Shares as consideration for acquisitions or investments, which would result in a dilution of Shareholders' respective shareholdings. Equity issues may result in a change of control of the Company.

9. Risk Related to International Compliance: The Company's growth could involve increasing trading activity in a wide range of territories. This may play a fundamental part in the Company's strategy and business plan. Some jurisdictions might pose a higher regulatory burden, including regulatory permissions for the Company to operate and more stringent data protections regulations. If the Company is unable to trade (for any of these reasons) in these territories, then this could detrimentally impact the Company's performance in the future by reducing the profit available due to lower revenue and/or increased costs.

11. Currency Risk Ongoing management and operational costs will be denominated in British pounds sterling. However, the Company's growth prospects include increasing trading activity in a wide range of territories. The Company may therefore be exposed to ongoing currency risk. Consequently, changes in the exchange rates of these currencies may negatively affect the Company's cash flows, operating results or financial condition to a material extent. The Company does not intend to hedge its cash resources against risks associated with disadvantageous movements in the currency exchange rates for the time being. Therefore, currency exchange rate fluctuations may negatively affect the Company.

12. Growth company risks: The share price of early-stage companies can be highly volatile and shareholdings illiquid. Once listed on the Aquis Stock Exchange, such volatility in the price of Ordinary Shares and the illiquidity could cause investors to lose all or part of their investment because they may not be able to sell their Ordinary Shares at or above the price they paid. The price at which the Ordinary Shares are traded and the price which investors may realise, or their Ordinary Shares will be influenced by several factors, some specific to the Company and its operations and some which may affect quoted companies generally. These factors could include the performance of the Company and/or large purchases or sales of the Ordinary Shares, legislative changes and general economic, political, or regulatory conditions. Notwithstanding the fact that application has been made for the Ordinary Shares to be admitted to trading on the AQSE Growth Market, this should not be taken as implying that there will be a "liquid" market in the Ordinary Shares. Continued admission to the AQSE Growth Market is entirely at the discretion of the Aquis Stock Ex

Promotion of the Company for the benefit of the members as a whole

The Director's believe they have acted in the way most likely to promote the success of the Company for the benefit of

Its members as a whole, as required by s172 of the Companies Act 2006.

The requirements of s172 are for the Directors to:

• Consider the likely consequences of any decision in the long term,

• Act fairly between the members of the Company,

• Maintain a reputation for high standards of business conduct,

• Consider the interests of the Company's employees,

• Foster the Company's relationships with suppliers, customers and others, and

• Consider the impact of the Company's operations on the community and the environment.

The following paragraphs summarise how the Directors fulfil their duties:

Stakeholders of the Company include employees, shareholders, suppliers, creditors of the business and the community in which it operates.

The Directors, both collectively and individually, consider that they have acted in good faith to promote the success of the Company for the benefit of its Stakeholders as a whole (having regard to the matters set out in s172 of the Act) in the decisions taken during the period.

To ensure that the Board take account of the likely consequences of their decisions in the long term, they receive regular and timely information on all the key areas of the business including financial performance, operational matters risks and opportunities. The Company's performance and progress is also reviewed regularly.

The Directors' intentions are to behave responsibly towards all stakeholders and treat them fairly and equally, so that they all benefit from the long-term success of the Company.

The Directors have overall responsibility for determining the Company's purpose, values and strategy and for ensuring high standards of governance. The primary aim of the Directors is to promote the long-term sustainable success of the Company, generating value for stakeholders and contributing to the wider society. In the future, the Board will continue to review and challenge how the Company can improve its engagement with its stakeholders.

The Directors take environmental matters into deep consideration as part of their decision-making process and strive to be a responsible member of the wider community, minimising the Company's impact on the environment wherever possible.

ON BEHALF OF THE BOARD

Ajan Reginald, Director

30 September 2025

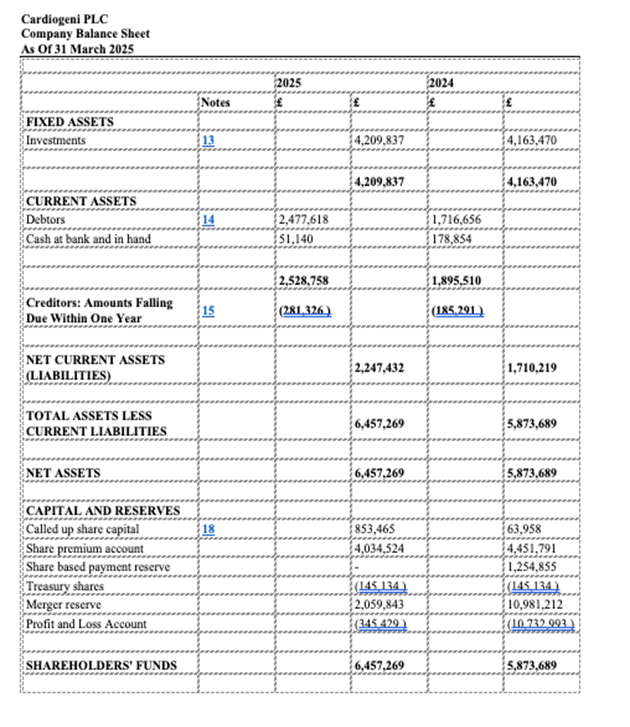

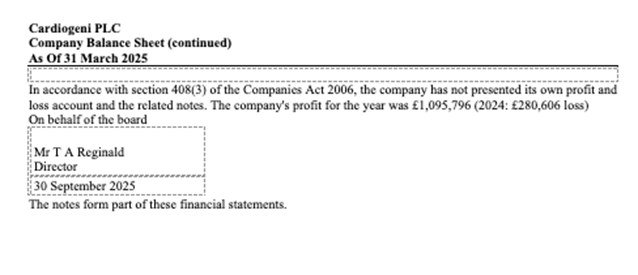

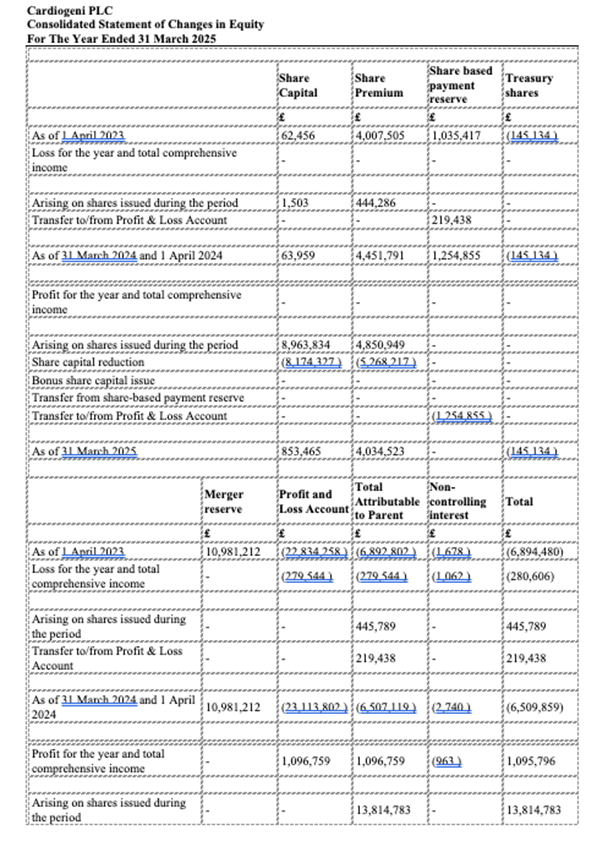

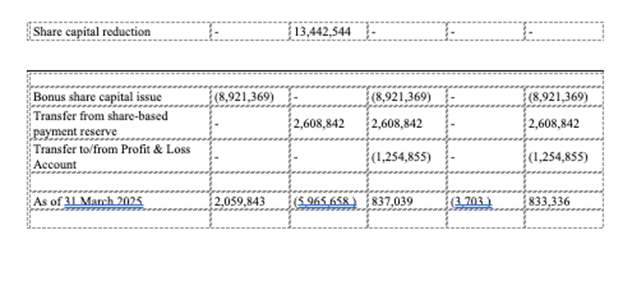

The Directors present their report together with the audited financial statements for the year ending 31 March 2025.

Results and dividends

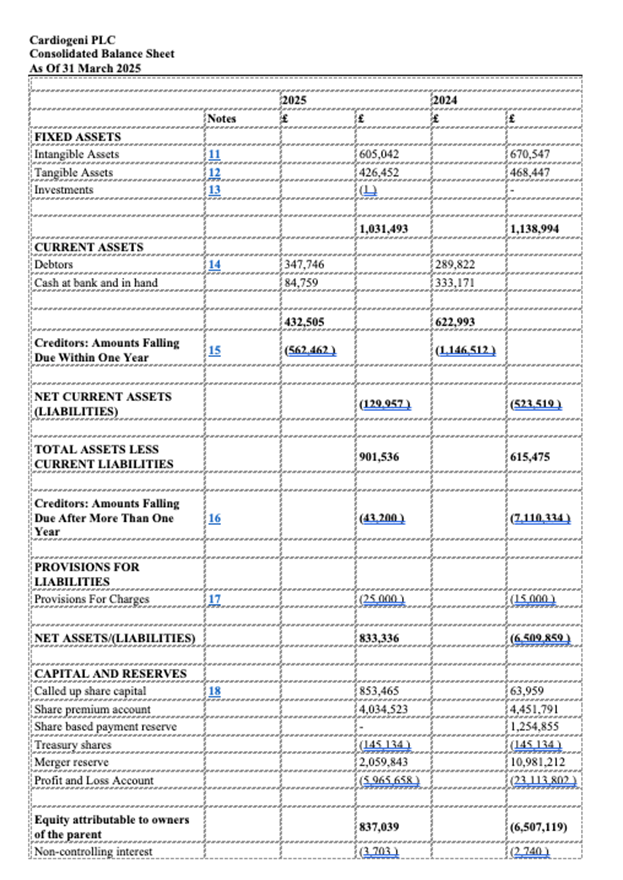

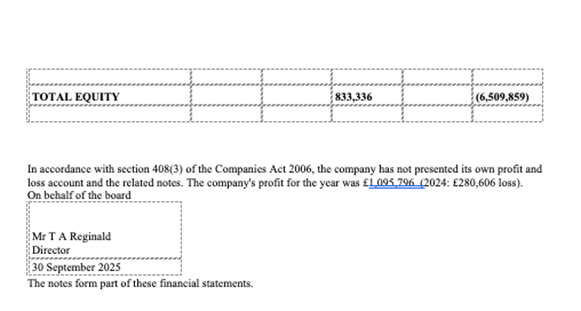

The trading results for the years ended 31 March 2025 and the Group's financial position at that date are shown in the attached financial statements. The Directors do not recommend the payment of a dividend for the year (2024 £Nil).

Principal activities and review of the business

The principal activity of the Group is the development and commercialisation of a portfolio of novel cellular medicines for heart failure. A review of the business is included within the Chairman's Statement and Strategic Report.

Directors serving during the year

Dr Darrin Disley

Professor Sir Martin Evans

(Trevor) Ajan Reginald

Chaim Hurvitz

Professor Joanne Martin

Directors' interests

The interests of the Directors and their immediate families and the persons connected with them (within the meaning of section 252 of the Act) in the issued share capital of the Company or the existence of which could, with reasonable diligence, be ascertained by any director as of 31st March 2025 are shown in the table below:

|

Director Name |

Ordinary Shares of |

% |

|

Ajan Reginald |

18,859,850 |

22.10% |

|

Kathryn Fallon |

5,880,730 |

6.89% |

|

Professor Sir Martin Evans |

4,111,234 |

4.82% |

|

Darrin Disley |

2,816,017 |

3.30% |

|

Chaim Hurvitz |

876,140 |

1.03% |

|

Professor Joanne Martin |

0 |

N/A |

After the period, on 29th August 2025, Ajan Reginald, Executive Director purchased a total of 12,001 ordinary shares of the Company. Following the purchase, Ajan Reginald's will hold 18,871,851 ordinary shares representing 22.11% of Cardiogeni's issued share capital.

Significant shareholders

As of 31st March 2025, the shareholders who or the existence of which could, with reasonable diligence, be ascertained by any director as at the 31st of March 2025 directly interested in 3% or more of the nominal value of the Company's share capital is as follows:

|

Holder Name |

Ordinary Shares of |

% |

|

LYNCHWOOD NOMINEES LIMITED |

25,628,012 |

30.03% |

|

Ajan Reginald |

18,859,850 |

22.10% |

|

The Sir Martin and Lady Judith Evans Family Trust |

11,660,680 |

13.66% |

|

Mubasher Sheikh |

8,576,760 |

10.05% |

|

Zita Sheikh |

6,000,000 |

7.03% |

|

Kathryn Fallon |

5,880,730 |

6.89% |

|

Martin Evans |

4,111,234 |

4.82% |

|

Darrin Disley |

2,816,017 |

3.30% |

Related party transactions

Related party transactions and relationships are disclosed below:

Pursuant to a loan agreement entered into between Cell Therapy Limited and Ajan Reginald dated 17 June 2022 ("Loan Agreement"), Ajan Reginald made a loan to Cell Therapy Limited for the sum of

Pursuant to the Accrued Debt Letters dated 24 January 2025, certain employees and directors of the Company were issued Subscription Shares conditional on Admission which were allotted and issued fully paid in respect of accrued loans due to such directors and employees. Any amounts due to such directors and employees not satisfied by Subscription Shares remain outstanding and become payable by the Company upon either the Company's completion of an equity fundraise which exceeds

Going concern

The Directors, having made due and careful enquiry, are of the opinion that the Group has adequate working capital to meet its obligations over the assessed period to the end of at least 12 months from the date of approval of these financial statements. The Directors have made an informed judgement at the time of approving the financial statements that there is a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future. As a result, the Directors have adopted the going concern basis of accounting in the preparation of the annual financial statements.

Events after the reporting date:

22nd May 2025: Raised

5th June 2025: Formation of a joint venture company in the

2nd July 2025: Appointed SP Angel Corporate Finance LLP as the Company's Corporate Broker.

24th of July: EIS funding round including advanced subscription agreements of

29th August 2025: Ajan Reginald, Executive Director purchased a total of 12,001 ordinary shares of the Company. Following the purchase, Ajan Reginald's will hold 18,871,851 ordinary shares representing 22.11% of Cardiogeni's issued share capital.

29th August 2025: Appointed Lord James Bethell as Non-Executive Director.

Suppliers

Strong relationships with suppliers are maintained, including by seeking to pay suppliers within their agreed terms at all times.

Provision of information to Auditor

In so far as each of the Directors are aware at the time of approval of the report:

• there is no relevant audit information of which the Group's auditor is unaware; and

• the Directors have taken all steps that they ought to have taken to make themselves aware of any relevant audit information and to establish that the auditor is aware of that information.

Auditor

Grenfell James LLP have expressed their willingness to continue as auditor and a resolution to re-appoint Grenfell James LLP will be proposed at the Annual General Meeting.

On behalf of the Board of Directors

Ajan Reginald

Director

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The directors are responsible for preparing the Report of the Directors and the financial statements in accordance with applicable law and regulations.

Company law requires the directors to prepare financial statements for each financial year. Under that law the directors have elected to prepare the financial statements in accordance with United Kingdom Generally Accepted Accounting Practice (United Kingdom Accounting Standards and applicable law). Under company law the directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the company and the group and of the profit or loss of the group for that period. In preparing these financial statements, the directors are required to:

· select suitable accounting policies and then apply them consistently;

· make judgements and accounting estimates that are reasonable and prudent;

· prepare the financial statements on the going concern basis unless it is inappropriate to presume that the company will continue in business.

The directors are responsible for keeping adequate accounting records that are sufficient to show and explain the company's and the group's transactions and disclose with reasonable accuracy at any time the financial position of the company and the group and enable them to ensure that the financial statements comply with the Companies Act 2006. They are also responsible for safeguarding the assets of the company and the group and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

STATEMENT AS TO DISCLOSURE OF INFORMATION TO AUDITORS

So far as the directors are aware, there is no relevant audit information (as defined by Section 418 of the Companies Act 2006) of which the group's auditors are unaware, and each director has taken all the steps that he or she ought to have taken as a director in order to make himself or herself aware of any relevant audit information and to establish that the group's auditors are aware of that information.

AUDITORS

The auditors, Grenfell James LLP, Statutory Auditor, will be proposed for re-appointment at the forthcoming Annual General Meeting.

Report of the Directors

for the Year Ended 31 March 2025

This report has been prepared in accordance with the provisions of Part 15 of the Companies Act 2006 relating to small companies.

ON BEHALF OF THE BOARD:

Dr Darrin M Disley OBE

Director 30 September 2025

Report of the Independent Auditors

Opinion

We have audited the financial statements of Cardiogeni PLC (the 'parent company') and its subsidiaries (the 'group') for the year ended 31 March 2025 which comprise the Consolidated Income Statement, Consolidated Balance Sheet, Company Balance Sheet, Consolidated Statement of Changes in Equity, Company Statement of Changes in Equity and Notes to the Financial Statements, including a summary of significant accounting policies. The financial reporting framework that has been applied in their preparation is applicable law and United Kingdom Accounting Standards, including Financial Reporting Standard 102 'The Financial Reporting Standard applicable in the

In our opinion the financial statements:

· give a true and fair view of the state of the group's and of the parent company affairs as at 31 March 2025 and of the group's profit for the year then ended;

· have been properly prepared in accordance with United Kingdom Generally Accepted Accounting Practice; and;

· have been prepared in accordance with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (

Material uncertainty relating to going concern

We draw attention to Going Concern statement of the financial statements which indicates that the ability of the company to continue as a going concern relies upon future funding to be secured and the directors acknowledge that there can be no absolute certainty that funding will be available to the company. These events and conditions, along with the other matters explained in Going Concern statement, constitute a material uncertainty that may cast significant doubt on the company's ability to continue as a going concern.

Our opinion is not modified in respect of this matter.

Other information

The directors are responsible for the other information. The other information comprises the information in the Report of the Directors but does not include the financial statements and our Report of the Auditors thereon. Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether this gives rise to a material misstatement in the financial statements themselves. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Report of the Independent Auditors:

Opinions on other matters prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of the audit:

- the information given in the Report of the Directors for the financial year for which the financial statements are prepared is consistent with the financial statements; and

- the Report of the Directors has been prepared in accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the group and the parent company and its environment obtained in the course of the audit, we have not identified material misstatements in the Report of the Directors.

We have nothing to report in respect of the following matters where the Companies Act 2006 requires us to report to you if, in our opinion:

- adequate accounting records have not been kept by the parent company, or returns adequate for our

audit have not been received from branches not visited by us; or

- the parent company financial statements are not in agreement with the accounting records and returns;

or

- certain disclosures of directors' remuneration specified by law are not made; or

- we have not received all the information and explanations we require for our audit; or

- the directors were not entitled to prepare the financial statements in accordance with the small companies

regime and take advantage of the small companies' exemption from the requirement to prepare a Group Strategic Report or in preparing the Report of the Directors.

Responsibilities of directors

As explained more fully in the Statement of Directors' Responsibilities set out on page two, the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such internal control as the directors determine necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the group's and the parent company's ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the group or the parent company or to cease operations, or have no realistic alternative but to do so.

Auditors' responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue a Report of the Auditors that includes our opinion. Reasonable assurance is a high level of assurance but is not a guarantee that an audit conducted in accordance with ISAs (

The extent to which our procedures are capable of detecting irregularities, including fraud is detailed below:

We obtained an understanding of the legal and regulatory frameworks that are applicable to the Company and determined that the most significant are those that relate to the reporting framework (

We understood how the Company is complying with those frameworks by making enquiries of management and those responsible for legal and compliance procedures.

We assessed the susceptibility of the Company's financial statements to material misstatement, including how fraud might occur. We considered the risk of fraud through management override and concluded that this presented limited risk. We also considered the possibility of fraudulent or corrupt payments made through third parties and conducted testing on third party vendors. These procedures included the testing of transactions back to source information and were designed to provide reasonable assurance that the financial statements were free from fraud or error.

Based on the results of our risk assessment we designed our audit procedures to identify non-compliance with such laws and regulations identified above. Our procedures involved journal entry testing, with a focus on journals meeting our defined risk criteria based on our understanding of the business.

We did not identify any material instances of non-compliance with laws and regulations. Because of the inherent limitations of an audit, there is a risk that we will not detect all irregularities, including those leading to a material misstatement in the financial statements or non-compliance with regulation. This risk increases the more that compliance with law or regulation is removed from the events and transactions reflected in the financial statements, as we will be less likely to become aware of instances of non-compliance. The risk is also greater regarding irregularities occurring due to fraud, as fraud involves intentional concealment, forgery, collusion, omission or misrepresentation.

We found no evidence of fraud and noted that there is no obvious incentive for management override and consider that the audit team collectively had the appropriate competence to identify non-compliance with laws and regulations. Our audit work led us to conclude that the risk of material misstatement was low.

A further description of our responsibilities for the audit of the financial statements is located on the Financial Reporting Council's website at www.frc.org.uk/auditorsresponsibilities. This description forms part of our Report of the Auditors.

Use of our report

This report is made solely to the company's members, as a body, in accordance with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been undertaken so that we might state to the company's members those matters we are required to state to them in a Report of the Auditors and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the company and the company's members as a body, for our audit work, for this report, or for the opinions we have formed.

Edward Grenfell James (Senior Statutory Auditor) for and on behalf of

Grenfell James Audit LLP, 13 The Courtyard, Timothy's Bridge Road, Stratford Upon Avon, CV37 9NP

30 September 2025

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.