Majestic Corporation - Interim Results to 30 June 2025

Announcement provided by

Majestic Corporation Plc · MCJ30/09/2025 07:00

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM

OR

30 September 2025

Majestic Corporation Plc

(the "Company" or Majestic")

Interim Results to 30 June 2025

Majestic Corporation plc (AQUIS: MCJ), a sustainable circular economy solutions provider specialising in recycling precious and non-ferrous metals, is pleased to announce its interim results for the 6-month period ended 30 June 2025.

Peter Lai, Founder, CEO and Chairman of Majestic, said:

"We are pleased to announce our interim results for the first half of the year.

We achieved a 22% increase in gross profit margin compared to the same period last year - a strong indicator of our progress in strengthening operational efficiency and testament to our disciplined execution in enhancing returns. Profit before tax rose to

Revenue stood at

Despite these external pressures, our ability to still enhance profitability demonstrates the strength of our diversified portfolio and strategic market positioning. The improvement in gross margin was driven by exceptional performance in the

Despite volatility in global commodity markets, we reinforced our leadership in recovering and reintroducing valuable metals into the global supply chain, broadening our global customer base and positioning the business for continuous profitable growth.

Working towards our target of processing 100,000 tonnes of material by 2030, we are pleased to report strong progress in delivering our

A key milestone in this journey will be the launch of our new 50,000 sq. ft. facility in Wrexham in 2026, which will significantly increase capacity, enable the deployment of our proprietary processing technology, and support substantial

We remain confident that our strategic focus will continue to drive continuous profitable growth, create long-term shareholder value, and secure the supply of critical and precious metals for economies worldwide and future generations."

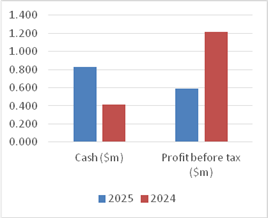

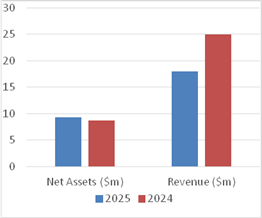

Financial highlights:

● Revenue was

● Gross Profit Margin 8.56% (HY 2024: 7.02%)

● Strong cash generation from operating activities

● Profit before tax

● Net assets

● Cash in bank and on hand of

● Earnings per share

-Ends-

For further information, please visit www.majestic-corp.com, or contact:

|

Majestic Corporation Plc Peter Lai (Chairman and CEO) Joe Lee (CFO) |

E: peter@majestic-corp.com

E: joe@majestic-corp.com |

|

Guild Financial Advisory Limited - Corporate Adviser Ross Andrews Evangeline Klaassen |

T: +44 (0)7973 839767 E: ross.andrews@guildfin.co.uk

T: +44 (0)7972 841276 E: evangeline.klaassen@guildfin.co.uk |

|

Redchurch Communications - Financial PR & IR John Casey / Nicky Bagheri |

T: +44 (0) 207 870 3974 E: mcj@weareredchurch.com |

About the Company

Majestic Corporation PLC is an emerging leader in sustainable circular economy solutions, specialising in recycling and recovering precious and base metals from everyday materials such as electronics, catalytic converters, and solar and battery materials. The company serves some of the world's largest brands, including Original Equipment Manufacturers (OEMs), blue-chip multinational corporations, financial and leasing businesses, and state and federal governments.

CHAIRMAN AND CEO'S REPORT

FOR THE PERIOD ENDED 30 JUNE 2025

The Board of Majestic Corporation Plc is pleased to announce the Company's unaudited interim results for the six months ended 30 June 2025.

Statement from Chairman and CEO

Dear Shareholders,

The global metals recycling industry is entering a pivotal new phase. Traditional models that rely heavily on cross-border flows of scrap and refined metals are being tested. Emerging tariffs, regulatory barriers, and supply chain risks are fragmenting long-established trade routes. At the same time, governments, industries, and consumers are demanding more transparent, lower-carbon, and traceable supply chains.

The first half of the year presented both challenges and opportunities. Volatility in global commodity markets persisted, with ferrous scrap prices under pressure - a commonly cited economic bellwether. High interest rates, ongoing inflation, and rising logistics and energy costs added pressure across the value chain, while protectionist policies continued to reshape the landscape of global trade.

Against this backdrop, Majestic Corporation continues to grow in relevance and resilience. Our model is built for this moment.

Our mission is to recover, refine, and reintroduce high-value metals into global supply chains through net-zero, circular economy infrastructure. This strategy directly addresses the rising need for localised, sustainable, and compliant material solutions - especially in an era where environmental standards and geopolitical realities are reshaping how resources are accessed and utilised.

Industry Landscape

The metals recycling sector is at the centre of one of the most significant industrial transformations in modern history. The transition to a low-carbon economy demands vast quantities of copper, aluminium, and other critical metals, while manufacturers and governments increasingly require sustainable, traceable sources of supply.

● Ferrous markets remain subdued, with weakened demand across

● Non-ferrous metals, especially copper and aluminium, continue to benefit from growth in manufacturing, electrification, grid investment, and renewable energy development.

● Precious group metals (PGMs) and critical materials are structurally undersupplied, with rising demand driven by clean technologies, advanced electronics, and electric mobility.

● Tariffs and trade barriers are disrupting global flows of scrap and refined metals, introducing pricing volatility and exposing vulnerabilities in supply chains. These dynamics reinforce the importance of local, net-zero facilities capable of processing materials closer to their point of origin.

● Our peers and customers report similar conditions across their markets, further validating the growing importance of multi-metal recovery and integrated recycling platforms. Majestic's strategic focus on PCBs, PGMs, and non-ferrous recovery places us at the convergence of these global trends - positioning us as a key player in the future of responsible material supply.

Financial Performance

Revenue for the half-year was

This margin improvement was driven by:

● A strategic shift in 2024 to expand revenue streams, followed by a 2025 focus on enhancing margins.

● Improved realisations in PGM, stainless steel, copper, and aluminium material streams.

● Better margins achieved in non-ferrous and precious group metals, despite price volatility and a decline in battery metal revenues.

● Underlying EBITDA was

○ Increased marketing efficiency

○ Enhanced material recovery rates

○ Net Profit After Tax stood at

The balance sheet remains strong, with net assets of

Strategic Report

During the first half of the year, we made strong progress in advancing Majestic Corporation's long-term vision:

● Expansion of Core Recovery Streams: Growth in our printed circuit board (PCB) processing and non-ferrous metal recovery has deepened our role in supplying sustainable materials to the IT infrastructure, electric vehicle (EV), and renewable energy sectors.

● Successful Capital Raise: In June 2025, the Company raised gross proceeds of

● Strategic Acquisition: We completed the acquisition of TeleCycle Europe Limited, a

● New Facility in Wrexham: Later this year, we will begin operations at our new site in Wrexham, which will significantly expand our local processing capacity.

● Our proprietary digital app is currently undergoing validation by Apple and Google. Once live, it will enhance our ability to source recyclable materials from smaller collectors and individual contributors, further strengthening our upstream supply network."

● Further to the announcement on 17 July 2025 regarding the planned launch of a new 50,000 sq ft facility in Wrexham,

Related Party Disclosure

On 6 May 2025, the Company announced the successful completion of its Share Purchase Agreement ("SPA") to acquire the entire issued share capital of Telecycle Europe Limited ("Telecycle") (the "Acquisition"). Telecycle, is a profitable

As Peter Lai is a Director of Majestic, as well as Director and the sole shareholder of Telecycle, this Acquisition is considered a related party transaction. The Board of Directors of Majestic (excluding Peter Lai) confirmed the completion of this SPA to be fair and reasonable for Majestic's shareholders.

Principal Risks and Uncertainties

While the Group remains confident in its strategic direction, it recognises a number of ongoing and emerging risks that may impact operations and financial performance during the remainder of the financial year.

These principal risks and uncertainties are consistent with those outlined in the 2024 Annual Report.

This summary does not represent an exhaustive list of all risks faced by the Company, but rather reflects the Board's current view of the most material factors that could affect the achievement of strategic objectives.

● Geopolitical Tensions: Heightened political instability in key regions continues to pose risks to global trade relationships and critical supply chains, which may affect the Group's sourcing and distribution activities.

● Tariffs and Trade Barriers: The imposition or escalation of tariffs on metal products may distort pricing dynamics, disrupt cross-border trade flows, and introduce regional supply-demand imbalances.

● Government Market Intervention: Regulatory actions by governments or trade blocs - such as price controls or subsidy adjustments -may artificially influence market pricing and create uncertainty for commercial planning.

● Supply Chain Disruptions: Logistical bottlenecks, transport delays, and supplier constraints remain a risk to the timely procurement of raw materials and delivery of processed products.

● Macroeconomic Headwinds: Broader economic conditions, including persistent inflation, rising interest rates, and regional economic slowdowns, may weaken industrial production and suppress downstream demand.

● Market Volatility: Fluctuating demand and pricing, particularly for scrap metals, are exacerbated by inconsistent global manufacturing activity and evolving policy landscapes. This complicates inventory management and may affect long-term contract viability.

● Export Restrictions: Retaliatory tariffs from major trading partners - including the EU,

● Domestic Oversupply and Depressed Pricing: Limited export options may result in domestic oversupply of scrap, exerting downward pressure on prices. This will require tighter inventory controls and development of more robust domestic sales channels.

● Reduced Downstream Demand: Elevated primary metal costs could constrain production in key sectors such as automotive, construction, and packaging - ultimately reducing demand for both virgin and recycled materials.

Looking Ahead

The near-term operating environment is expected to remain challenging, characterised by ongoing price volatility, trade tensions, and tariff-related disruptions. These dynamics continue to introduce friction into cross-border trade of both scrap and refined metals, potentially limiting access to traditional markets and increasing the complexity of global supply chains.

Despite these headwinds, the long-term outlook for the sector remains highly compelling. Global trends such as urbanisation, electrification, and decarbonisation are expected to significantly increase demand for critical materials, including copper, aluminium, and platinum group metals (PGMs).

At the same time, a growing emphasis on regulatory compliance, sustainability, and transparency - driven by both policymakers and end customers - is reshaping global supply chains in favour of businesses that can meet these evolving expectations.

Majestic Corporation is strategically positioned to lead in this new era. Our focus is on combining technological innovation in metal recovery with a replicable, net-zero facility model. Through strategic partnerships with suppliers and end users, and by building a decentralised network of localised processing hubs, we are actively mitigating the risks associated with global trade volatility and tariffs.

Our ambition is not only to scale further and deeper globally, but to do so responsibly - enabling the transition to a truly circular economy while securing long-term growth for our business and value for our shareholders.

Responsibilities Statement

The Directors confirm to the best of their knowledge:

● the interim financial statements have been prepared in accordance with International Accounting Standard 34, Interim Financial Reporting;

● the interim financial statements give a true and fair view of the assets and liabilities, financial position and profit of the Group;

● the Interim Report includes a fair review of the information required by DTR 4.2.7R, being an indication of important events that have occurred during the first six months of the financial year and their impact on the interim financial information, and a fair description of the principal risks and uncertainties for the remaining six months of the year; and

● the interim financial information includes a fair review of the information required by DTR 4.2.8R, being the information required on related party transactions.

● The interim financial statements were approved by the Board of Directors and the above responsibility statement was signed on its behalf by:

Peter Lai Chairman & CEO

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

FOR THE PERIOD ENDED 30 JUNE 2025

|

(Expressed in |

|

|

|

|||||

|

|

Notes |

Unaudited Six months ended

|

|

Audited Year ended |

|

Unaudited Six months ended

|

|

|

|

|

|

30.06.2025 |

|

31.12.2024 |

|

30.06.2024 |

|

|

|

Turnover |

4 |

18,221,665 |

|

49,292,716 |

|

24,987,840 |

|

|

|

Cost of goods sold |

|

(16,661,465) |

|

(47,163,943) |

|

(23,232,770) |

|

|

|

Gross Profit |

|

1,560,200 |

|

2,128,773 |

|

1,755,070 |

|

|

|

Other income |

4 |

23,508 |

|

115,410 |

|

1,060 |

|

|

|

Administrative expenses |

|

(993,166) |

|

(1,237,522) |

|

(539,520) |

|

|

|

Profit from operation and before taxation |

5 |

590,542 |

|

1,006,661 |

|

1,216,610 |

|

|

|

Taxation |

|

- |

|

(123,493) |

|

(175,643) |

|

|

|

Profit for the period |

|

590,542 |

|

883,168 |

|

1,040,967 |

|

|

|

Other comprehensive income for the period |

|

- |

|

- |

|

- |

|

|

|

Total comprehensive income for the period |

|

590,542 |

|

883,168 |

|

1,040,967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share (cents per share) |

|

2.92 |

|

4.42 |

|

5.2 |

|

|

|

|

|

|

|

|

|

|

|

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2025

|

(Expressed in

|

|

Notes |

Unaudited Six months ended 30.06.2025 |

|

Audited Year ended

31.12.2024 |

|

Unaudited Six months ended 30.06.2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIXED ASSETS |

|

55,287 |

|

- |

|

- |

|

|

|

|

GOODWILL |

15 |

2,438,152 |

|

- |

|

- |

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

|

Inventories |

8 |

14,713,734 |

|

16,252,406 |

|

16,066,683 |

|

|

|

|

Trade receivables |

9 |

1,953,936 |

|

1,448,764 |

|

1,492,140 |

|

|

|

|

Prepayments and deposits |

|

2,336,761 |

|

1,816,047 |

|

2,211,995 |

|

|

|

|

Tax receivable |

|

33,851 |

|

33,851 |

|

- |

|

|

|

|

Amounts due from related companies |

|

1,220,035 |

|

1,959,700 |

|

540,602 |

|

|

|

|

Amount due from director |

|

165,120 |

|

225,701 |

|

197,539 |

|

|

|

|

Cash in bank and on hand |

|

826,125 |

|

1,479,407 |

|

414,646 |

|

|

|

|

|

|

21,249,562 |

|

23,215,876 |

|

20,923,605 |

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

|

Trade payables |

10 |

5,425,119 |

|

7,492,198 |

|

6,282,547 |

|

|

|

|

Deposits received |

|

2,914,822 |

|

4,115,958 |

|

3,335,862 |

|

|

|

|

Accruals and other payables |

|

2,400,911 |

|

237,443 |

|

29,178 |

|

|

|

|

Amounts due to related companies |

|

151,228 |

|

- |

|

645,041 |

|

|

|

|

Import loans |

11 |

3,461,264 |

|

2,840,463 |

|

1,726,477 |

|

|

|

|

Tax payable |

|

53,683 |

|

- |

|

218,858 |

|

|

|

|

|

|

14,407,027 |

|

14,686,062 |

|

12,237,963 |

|

|

|

|

NET CURRENT ASSETS |

|

6,842,535 |

|

8,529,814 |

|

8,685,642 |

|

|

|

|

NET ASSETS |

|

9,335,974 |

|

8,529,814 |

|

8,685,642 |

|

|

|

|

CAPITAL AND RESERVE |

|

|

|

|

|

|

|

|

|

|

Called up share capital |

12 |

137,387 |

|

135,919 |

|

135,919 |

|

|

|

|

Share premium |

|

636,637 |

|

403,217 |

|

403,217 |

|

|

|

|

Capital reserve |

|

4,767,431 |

|

4,767,431 |

|

4,767,431 |

|

|

|

|

Merger reserve |

|

(44,525) |

|

(44,525) |

|

(44,525) |

|

|

|

|

Foreign currency reserve |

|

(56,187) |

|

(36,917) |

|

(38,888) |

|

|

|

|

Retained profit |

|

3,895,231 |

|

3,304,689 |

|

3,462,488 |

|

|

|

|

|

|

9,335,974 |

|

8,529,814 |

|

8,685,642 |

|

|

|

|

|

|

|

|

|

|

|

|

||

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE PERIOD ENDED 30 JUNE 2025

(Expressed in

|

|

|

Share capital |

Share premium |

Capital reserve |

Merger reserve |

Foreign currency reserve |

Retained profits |

Total |

|

Balance as 1 January 2024

|

135,919 |

403,217 |

4,767,431 |

(44,525) |

(38,403) |

2,421,521 |

7,645,160 |

|

Profit for the period

|

- |

- |

- |

- |

- |

883,168 |

883,168 |

|

Foreign currency reserve

|

- |

- |

- |

- |

1,486 |

- |

1,486 |

|

Balance as 31 December 2024 |

135,919 |

403,217 |

4,767,431 |

(44,525) |

(36,917) |

3,304,689 |

8,529,814 |

|

Profit for the period

|

- |

- |

- |

- |

- |

590,542 |

590,542 |

|

New shares issued

|

1,468 |

233,420 |

- |

- |

- |

- |

234,888 |

|

Foreign currency reserve

|

- |

- |

- |

- |

(19,270) |

- |

(19,270) |

|

Balance as 30 June 2025 |

137,387 |

636,637 |

4,767,431 |

(44,525) |

(56,187) |

3,895,231 |

9,335,974 |

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW FOR THE PERIOD ENDED 30 JUNE 2025

(Expressed in

|

|

|

Unaudited Six months ended 30.06.2025 |

Audited Year ended 31.12.2024 |

Unaudited Six months ended 30.06.2024 |

|

OPERATING ACTIVITIES |

|

|

|

|

Profit for the period |

590,542 |

883,168 |

1,040,967 |

|

Adjustment: |

|

|

|

|

Exchange difference |

(19,204) |

1,486 |

(485) |

|

Cost of goods sold |

16,661,465 |

47,163,943 |

23,232,770 |

|

Operating profit before working capital changes |

17,232,803 |

48,048,597 |

24,273,252 |

|

Changes in working capital |

|

|

|

|

Purchase of inventories |

(14,281,434) |

(48,270,595) |

(24,153,699) |

|

(Increase)/decrease in trade and other receivables |

(1,032,690) |

(1,396,226) |

(354,439) |

|

(Decrease)/Increase in trade and other payables |

(937,522) |

999,887 |

(334,226) |

|

NET CASH GENERATED/(USED) TO OPERATING ACTIVITIES |

981,157 |

(618,337) |

(569,112) |

|

INVESTING ACTIVITIES

|

|

|

|

|

Acquisition of a subsidiary - consideration |

(2,668,000) |

- |

- |

|

Acquisition of a subsidiary - cash acquired |

177,872 |

- |

|

|

NET CASH USED TO INVESTING ACTIVITIES |

(2,490,128) |

- |

- |

|

FINANCING ACTIVITIES |

|

|

|

|

Withdrawal/(Repayment) of import loans |

620,801 |

1,444,986 |

331,000 |

|

Share issued |

234,888 |

- |

- |

|

NET CASH (USED)/GENERATED FROM FINANCING ACTIVITIES |

855,689 |

1,444,986 |

331,000 |

|

|

|

|

|

|

NET (DECREASE)/INCREASE IN CASH AND CASH EQUIVALENTS |

(653,282) |

826,649 |

(238,112) |

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS AT BEGINNING OF THE PERIOD

|

1,479,407 |

652,758 |

652,758 |

|

CASH AND CASH EQUIVALENTS AT THE END OF THE PERIOD |

826,125 |

1,479,407 |

414,646 |

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS FOR THE PERIOD ENDED 30 JUNE 2025

(Expressed in

|

1. GENERAL INFORMATION AND BASIS OF PREPARATION

The Company is a public company, limited by shares, and incorporated and domiciled in the

The address of its registered office and the principal place of business are located Unit 15 Drome Road, Deeside Industrial Park, Deeside,

The financial statements are presented in

2. BASIS OF PREPARATION AND ACCOUNTING POLICIES

Basis of preparation

These interim condensed consolidated financial statements (Interim Financial Statements) Majestic Corporation Group Plc comprise the results of the Group for the 6 months ended 30 June 2025.

The consolidated reserves of the Group have been adjusted in the current period following the share-for-share exchange to reflect the share capital of the Company with the difference giving rise to a merger reserve.

The condensed set of financial statements included in this half-yearly financial report has been prepared in accordance with

The information for the period ended 30 June 2025 has neither been audited nor reviewed and does not constitute statutory accounts as defined in Section 434 of the Companies Act 2006.

3. PRINCIPAL ACCOUNTING POLICIES

The principal accounting policies adopted are set out below.

a. Basis of accounting and accounting policies

The financial statements have been prepared under the historical cost basis.

b. Revenue recognition

Revenue from the sales of goods is recognised when control of the goods has transferred, being when the goods have been shipped to the customer's specific location. Following delivery, the customer has full discretion over the usage of the goods, has the primary responsibility upon selling the goods and bears the risks in relation to the goods. A receivable is recognised by the Company when the goods are delivered to the customers as this represents the point in time at which the right to consideration becomes unconditional, as only the passage of time is required before payment is due.

Interest income is recognised as other income as it accrues using the effective interest method.

c. Cash and cash equivalents

Cash and cash equivalents include demand deposits and other short-term highly liquid investments with original maturities of three months or less.

d. Trade and other receivables

Trade and other receivables are stated at estimated realisable value after each debt has been considered individually. Where the payment of a debt becomes doubtful a provision is made and charged to the income statement.

e. Trade and other payables

Trade and other payables are recognised initially at the transaction price and subsequently measured at amortised cost using the effective interest method.

f. Translation of foreign currency

Foreign currency transactions during the period are translated into United States Dollars at the exchange rates ruling at the transaction dates. Monetary assets and liabilities denominated in foreign currencies are translated into United States Dollars at the market rates of exchange ruling at the reporting date. Exchange gains and losses on foreign currency translation are dealt with in the statement of income and retained earnings.

g. Taxation

The tax expense in the consolidated income statement comprises current tax payable and deferred tax.

h. Inventories

Inventories are stated at the lower of cost and net realisable value. In arriving at net realisable value an allowance has been made for deterioration and obsolescence.

i. Goods in transit

The risk and reward of the inventory transfers to customers once they have issued an analysis report confirming shipment has been accepted.

j. Leases

Leases are classified as operating leases and the rentals receivable or payable under these leases are credited or charged to the statement of income and retained earnings on a straight-line basis over the duration of the leases.

k. Going concern

The consolidated financial statements are prepared on the going concern basis. The financial position of the Company, its cash flows and liquidity position are described in the interim consolidated financial statements and notes. The Company has the financial resources to continue in operation for the foreseeable future, a period of not less than 12 months from the date of the report.

4. TURNOVER AND OTHER INCOME

Turnover represents the amounts received and receivables for goods sold to the customers.

Other income in 2025 represents supplier credit received.

5. PROFIT FROM OPERATION AND BEFORE TAXAION

Profit from operation and before taxation have been arrived at after charging:

|

|

Unaudited |

Unaudited |

|

30.06.2025 |

30.06.2024 |

|

|

Finance costs |

109,919 |

82,519 |

|

Cost of goods sold |

16,661,465 |

23,232,770 |

|

6. DIRECTORS REMUNERATIONS |

|

|

|

|

|

Director's remunerations disclosed is as follows: |

|

|

||

|

|

Unaudited |

Unaudited |

||

|

|

30.06.2025 |

30.06.2024 |

|

|

|

Fees |

- |

- |

|

|

|

Other emoluments |

98,567 |

90,464 |

|

|

|

|

98,567 |

90,464 |

|

|

|

7. STAFF COST |

|

|

|

|

|

|

Unaudited |

Unaudited |

|

|

|

|

30.06.2025 |

30.06.2024 |

|

|

|

Salary |

98,199 |

68,386 |

|

|

|

Mandatory provident fund |

4,592 |

5,040 |

|

|

|

|

102,791 |

73,426 |

|

|

|

8. INVENTORIES |

|

|

|

Inventories comprise entirely of stock in trade. |

Unaudited |

Audited |

|

|

30.06.2025 |

31.12.2024 |

|

Stock in warehouse |

3,279,632 |

4,571,955 |

|

Stock in transit |

11,434,102 |

11,680,451 |

|

|

14,713,734 |

16,252,406 |

9. TRADE RECEIVABLES

The ageing analysis of the trade receivables, based on invoice dates, is as follows:

|

|

Unaudited |

Audited |

|

30.06.2025 |

31.12.2024 |

|

|

Within one month |

1,946,143 |

1,440,613 |

|

1-3 months |

4,872 |

8,151 |

|

Over 3 months |

2,921 |

- |

|

|

1,953,936 |

1,448,764 |

Trade receivables disclosed above include amounts which are past due at the end of the reporting period against which the Company has not recognized an allowance for doubtful receivables because there has not been a significant change in credit quality and the amounts are recoverable subsequent to the reporting date. The Company does not hold any collateral or other credit enhancements over these balances, nor does it have a legal right of offset against any amounts owed by the Company to the counterparty.

10. TRADE PAYABLES

The ageing analysis of the trade payables, based on invoice dates, is as follows:

|

|

Unaudited |

Audited |

|

|

30.06.2025 |

31.12.2024 |

|

|

|

|

|

Within one month |

3,046,090 |

3,275,059 |

|

1-3 months |

1,457,868 |

1,368,936 |

|

Over 3 months |

921,161 |

2,848,203 |

|

|

5,425,119 |

7,492,198 |

11. IMPORT LOANS

The Company has obtained credit facilities from its bankers as secured by guarantees of the director and a related company together with fixed deposit of the Company. The loans are interest bearing at LIBOR+2%, TAIF03 + 1%, and repayable in 180 days from the drawdown date which has multiple repayment dates.

12. SHARE CAPITAL

|

|

Unaudited |

|

Audited |

|

|

30.6.2025 |

|

31.12.2024 |

|

Issued and fully paid |

|

|

|

|

20,214,002 ordinary shares of (2024 : 20,000,000 ordinary shares) |

137,387 |

|

135,919 |

13. FINANCIAL RISK MANAGEMENT

Exposure to credit, liquidity, interest rate, foreign currency and equity price risks arises in the normal course of the Company's business. The Company's exposure to these risks and the financial risk management policies and practices used by the Company to manage these risks are described below.

a. Credit risk management

In order to minimize credit risk, credit approvals and monitoring procedures are in place to ensure that follow-up action is taken to recover overdue debts.

b. Liquidity risk management

Ultimate responsibility for liquidity risk management rests with the board of directors, which has established an appropriate liquidity risk management framework for management of the Company's short, medium and long-term funding and liquidity management requirements. The Company manages liquidity risk by maintaining adequate reserves, banking facilities and reserve borrowing facilities, by continuously monitoring forecast and actual cash flows, and by matching the maturity profiles of financial assets and liabilities.

c. Market risk management - interest rate risk

The Company draws import loans to maintain stable cashflow. The loan is interest bearing at LIBOR+2.5%. 5% is the sensitivity rate used when reporting interest rate risk internally to key management personnel and represents management's assessment of the reasonably possible change in interest rates. The Company's sensitivity to a 5% increase and decrease in LIBOR is as follows:

Unaudited Unaudited

30.06.2025 31.06.2024

|

5% increase effect on profit for the year |

(13,351) |

(4,913) |

|

5% decrease effect on profit for the year |

13,351 |

4,913 |

d. Market risk management - foreign currency risk

The Company undertakes most of the transactions denominated in

Unaudited Unaudited

30.06.2025 31.06.2024

|

5% increase effect on loss for the year |

(54,708) |

(128,619) |

|

|

5% decrease effect on loss for the year |

54,708 |

128,619 |

|

14. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the net profit/(loss) for the period attributable to ordinary equity holders of the parent by the weighted average number of ordinary shares in issue during the period. As the condensed consolidated interim financial statements have been presented as a continuation of the existing group, the number of shares taken as being in issue for both the current and preceding periods are deemed to be the number of ordinary shares issued by Majestic Corporation Plc to acquire Majestic Corporation Limited in the share for share exchange. The weighted average number of shares is then adjusted to reflect changes in the number of ordinary shares issued in Majestic Corporation Limited that occurred during the previous period.

The following reflects the income and share data used in the basic and diluted earnings per share computations:

|

|

Unaudited |

|

|

|

|

30.06.2025 |

|

|

|

Profits attributable to ordinary equity holders of the Company |

590,542 |

|

|

|

Average number of shares |

20,241,002 |

|

|

|

Earnings per share (cents per share) |

2.92 |

|

|

There have been no other transactions involving actual ordinary shares or potential ordinary shares between the reporting date and the date of authorisation of this financial information.

15. RELATED PARTY DISCLOSURE

On 6 May 2025, Majestic Corporation Plc acquired 100% of the share capital of Telecycle Europe Limited, a

As Peter Lai is a Director and 71.85% shareholder of Majestic, as well as a Director and the sole shareholder of Telecycle, this Acquisition is considered a related party transaction under the Aquis Stock Exchange Rules.

The following summarizes the provisional fair values of assets acquired, and liabilities assumed at the acquisition date:

Fixed assets :

Current assets :

Current liabilities :

Net assets :

Goodwill arising from the acquisition, which is the excess of the purchase price over the fair value of net assets acquired.

Purchase price :

Net assets acquired :

Goodwill :

Management is still assessing the fair values of identifiable intangible assets and will adjust the provisional fair values accordingly to recognize identified intangible assets at the year end. The recognition of intangible assets identified, net of applicable deferred tax, will have a corresponding adjustment in the value of goodwill recognized.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy.